Some creditors could see up to 142% of their claims paid back.

There’s some good news for creditors in the joint reorganization plan filed late Tuesday by FTX’s bankruptcy overseers.

FTX says it has collected between $14.5 billion and $16.3 billion in cash, and it’s ready to distribute those funds to creditors. It owes customers and other creditors around $11 billion. FTX says that 98% of its non-government creditors will receive “at least” 118% of claims in cash within two months of the plan being approved.

Some, including crypto loan creditors, could see up to 142% of their claims paid back, according to a court filing.

Others can expect to be paid in full and receive interest on their claims.

But don’t get too excited just yet. The plan still needs to be approved by the bankruptcy court. While it seems to check all of the boxes on paper, one should expect this process to take a while to play out.

Further, creditors shouldn’t expect to see their claims benefit from the recent crypto boom. Instead, the claims will be paid out according to November 2022 prices. Bitcoin hovered around $20,000 back then — a far cry from its current level of $62,000.

But that shouldn’t be a surprise after the judge said earlier this year that the bankruptcy code is “very clear” and that FTX doesn’t meet the criteria for an exception.

A press release about the new plan explained that debtors reached a series of settlements, including the IRS claims, an agreement with the CFTC, and a separate agreement with the DOJ.

The hope, according to the estate, is to resolve disputes “without costly and protracted litigation.” That’s something, I think, everyone can agree on.

Much of the funds came from the sales of Alameda and FTX Ventures investments, including the firm’s stake in Anthropic, which was approved for sale earlier this year. The estate also sold out of its position in Grayscale’s bitcoin ETF.

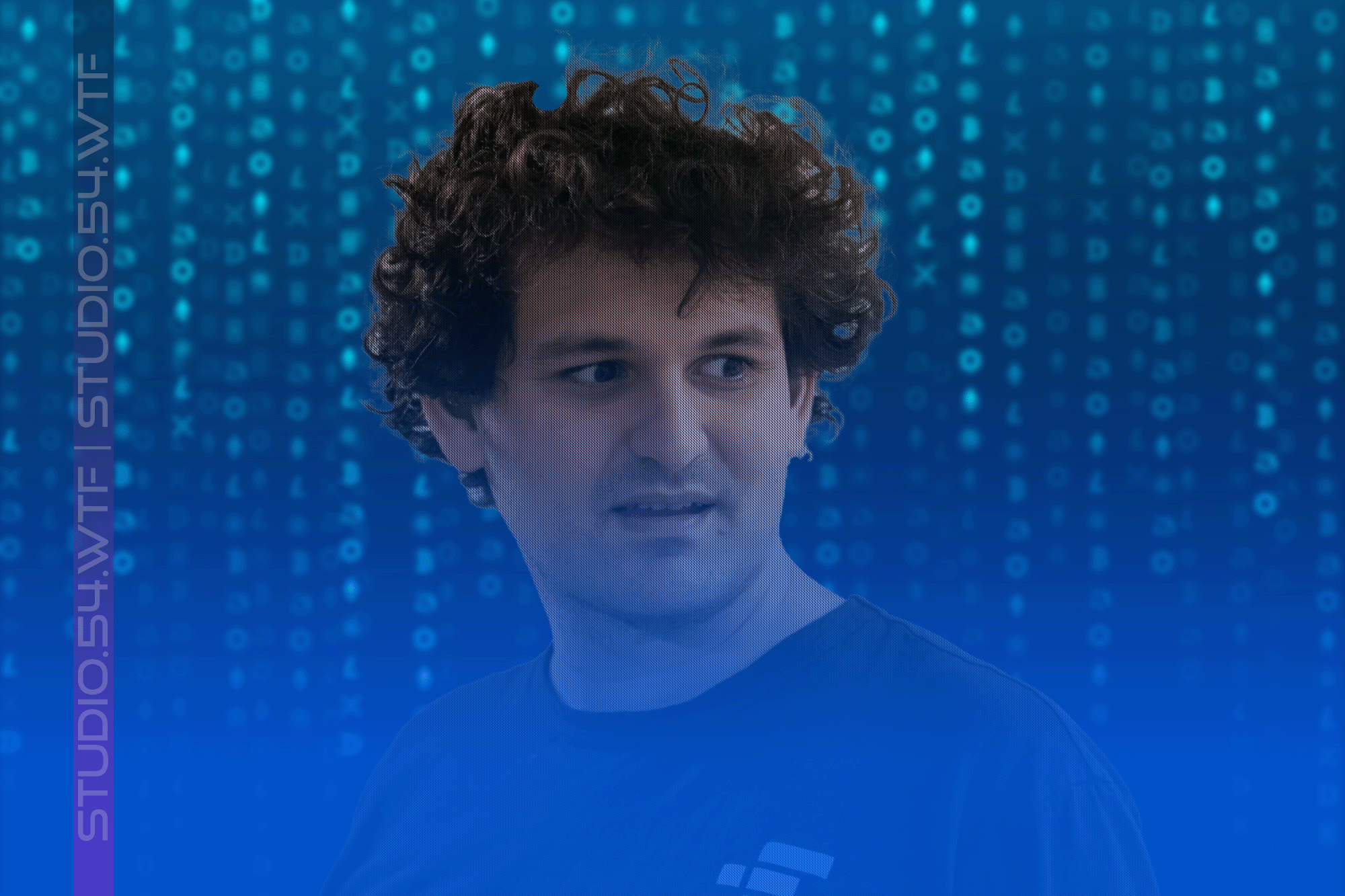

CEO John J. Ray, who took over from the now incarcerated Sam Bankman-Fried, expressed his optimism about the proposed plan, saying that the firm was “pleased” to be able to pay back creditors.

While there’s no denying that this plan is good news for creditors, the debtors previously teased that they had enough to pay people back. FTX lawyer Andrew Dietderich said in January that it expected to repay creditors in full “eventually.”

According to the bankruptcy docket, the court scheduled two hearings for later this summer.

Approval of the plan could represent one of the final steps in the closure of the FTX saga since Bankman-Fried was sentenced earlier this year after being found guilty of fraud.

It’s been a long journey since Ray took over nearly two years ago and said the bankruptcy represented an “unprecedented” mess. (That, coming from the guy who took over Enron’s bankruptcy, says a lot.)

Soon we can officially put FTX in the rearview mirror.

— Katherine Ross

Binance has a checkered past when it comes to getting along with countries and regulators.

The exchange still struggles with this today, as countries like Nigeria and the Philippines either move to block the exchange from operating or — in Nigeria’s case — detain executives and charge them with the same crimes as their employer.

Speaking of Nigeria, Binance stopped support for the naira as it continues to fight for the country to release Tigran Gambaryan, one of the aforementioned detained executives.

Binance’s own website claims that it’s available in over 100 countries. However, it only lists 44 countries. Binance didn’t return my multiple requests for comment on the discrepancy.

Here’s a fun little note: Binance’s site says it supports 19 European countries but lists Europe as one of those countries, alongside others like the Czech Republic and France.

Despite the multibillion-dollar settlement Binance agreed to pay the US government last year, operations in the US remain a sticky situation. Investors in the States — well, really, just certain states — can use the platform. Unfortunately, if you’re based in a handful of states, including my home state of Texas, you’re unable to use the US platform.

The exchange exited the Canadian market last year, citing regulatory concerns. Those worries didn’t seem to faze Coinbase, though, which received registration as a restricted dealer last month.

Binance is also blocked in China after the country took action against crypto a few years back. It ceased operations in South Korea back in 2020, citing low usage and volume.

Over in Europe, Binance left the Netherlands last year and withdrew its application for a crypto license in Germany. But the firm still operates in France and is available in other European countries including Spain.

The exchange did admit that French authorities made an on-site visit in June of last year, claiming that it was “fully collaborative” with said authorities.

According to a February report from Bloomberg, Binance is still trying to re-enter the UK market, but the company continues to face regulatory hurdles.

Oh, and did I mention that the company still doesn’t have a headquarters? Though new CEO Richard Teng did say — at Paris Blockchain Week — that the company was mulling a “few jurisdictions.”

Stay tuned.

— Katherine Ross

Turns out Gary Gensler’s not the biggest fan of crypto journalism.

The SEC Chair grew a bit frustrated yesterday during an interview with CNBC’s Andrew Ross Sorkin over the latter’s questioning on crypto.

Crypto, Gensler stressed, is “a small piece of our overall markets” but “an outsized piece of the scams and frauds and problems in our markets.” As a result, “you end up with, like, an outsized ratio of journalist questions and crypto journalists to market cap.”

Gensler basically accused Sorkin (and other journalists, I guess?) of focusing too much on crypto.

Okay, fair point, I suppose. But perhaps it’s equally fair to say that the SEC is seeking a budgetary bump thanks to its strong focus on crypto. And Gensler has made it pretty clear that he thinks the SEC ought to have a bigger, not smaller, role in overseeing an industry that has attracted billions of dollars of capital over a relatively short period.

There ought to be an equal trade off. Want more power? Prepare to answer more questions. Seems pretty fair to me.

— Michael McSweeney

Source: Katherine Ross & Michael McSweeney – blockworks.co